Australia’s stage 3 tax cuts are the last stage in the highly debated tax package the Federal Government first announced and implemented in 2018.

After much deliberation, the latest version of the Stage 3 tax cuts has been legislated and will come into effect on 1 July 2024. With it comes more tax relief for low and middle income earners but lower benefits than originally planned for higher income earners.

The revised tax cuts aim to reduce the amount of tax that is taken from the pay of Australian workers, potentially alleviating some of the cost-of-living pressures.

Your questions answered:

- What are the stage 3 tax cuts?

- What are the new marginal tax rates?

- How do the changes affect your income and your tax refund?

Here’s a ‘need to know’ look at the stage 3 tax cuts for 2024-25:

So, after all the flip, flopping and intense discussions, what exactly is the final outcome for this final round of tax cuts?

The stage 3 tax cuts look like this:

- The 19% marginal tax rate for individuals earning between $18,201 and $45,000 per year is reduced to 16%. In simple terms, for $100 you earn between those amounts, you pay $16 tax instead of $19.

- The upper income threshold increases in the 32.5% tax bracket from $120,000 to $135,000

- The 32.5% tax rate also lowers to 30%

- The government retained the 37% tax bracket, initially planned for removal in the original stage 3 tax cuts plan, and instead adjusted the threshold to include individuals earning between $135,001 and $190,000.

- High income earners (+$190,000 per year) will remain in the 45% tax bracket, though will benefit from the lower tax rates in other brackets.

New tax rates and income thresholds

Here are the new tax rates and income thresholds for 2024-25 tax year:

| Income thresholds: 2023-24 | Tax Rates: 2023-24 | NEW Income Thresholds 2024-25 | NEW Tax Rates: 2024-25 |

|---|---|---|---|

| $0 – 18,200 | 0% | $0 – 18,200 | 0% |

| $18,201 – 45,000 | 19% | $18,201 – 45,000 | 16% |

| $45,001 – 120,000 | 32.5% | $45,001 – 135,000 | 30% |

| $120,001 – 180,000 | 37% | $135,001 – 190,000 | 37% |

| $180,000+ | 45% | $190,000+ | 45% |

When do the stage 3 tax cuts start?

The stage 3 tax cuts come into effect on 1 July 2024. Keep an eye out for a small increase in your pay each week/fortnight/month from the first week of July onwards!

Will I get a bigger tax refund?

The simple answer is no, you won’t see an increase in your tax refund. The latest round of tax cuts will be seen as a pay increase rather than a tax refund, as your employer should adjust your pay accordingly.

So how does this latest round of cuts actually affect you?

Let’s compare 2023-24 with 2024-25 financial years:

2023-24 tax year:

- The median weekly income in Australia was $1,300 in 2023.

- During the 2023-24 financial year, tax withheld on this amount was: $265.17, giving an individual a take-home pay of $1,034.83.

With the implementation of the new stage 3 tax cuts in 2024:

- Using the same 2023 median weekly income of $1300 (to keep it simple), the tax withheld decreases to $238.85 per week.

- This increases the take-home pay of an individual to $1,061.15 – an increase of $26.32 per week.

What does that look like in an annual salary?

It may not seem like much of a weekly increase but it can amount to a decent sum in your annual salary, as our table shows:

(Source: https://treasury.gov.au/sites/default/files/2024-01/tax-cuts-government-fact-sheet.pdf )

| Taxable Income ($) | Tax withheld 2023-24 ($) | Tax withheld 2024-25 ($) | Tax Cut ($) |

|---|---|---|---|

| 30,000 | 1,942 | 1,588 | 354 |

| 40,000 | 4,367 | 3,713 | 654 |

| 50,000 | 7,467 | 6,538 | 929 |

| 60,000 | 11,067 | 9,888 | 1,179 |

| 70,000 | 14,617 | 13,188 | 1,429 |

| 80,000 | 18,067 | 16,388 | 1,679 |

| 90,000 | 21,517 | 19,588 | 1,929 |

| 100,000 | 24,967 | 22,788 | 2,179 |

| 110,000 | 28,417 | 25,988 | 2,429 |

| 120,000 | 31,867 | 29,188 | 2,679 |

| 130,000 | 35,767 | 32,388 | 3,379 |

| 140,000 | 39,667 | 35,938 | 3,729 |

| 150,000 | 43,567 | 39,838 | 3,729 |

| 160,000 | 47,467 | 43,738 | 3,729 |

| 170,000 | 51,367 | 47,638 | 3,729 |

| 180,000 | 55,267 | 51,538 | 3,729 |

| 190,000 | 59,967 | 55,438 | 4,529 |

| 200,000 | 64,667 | 60,138 | 4,529 |

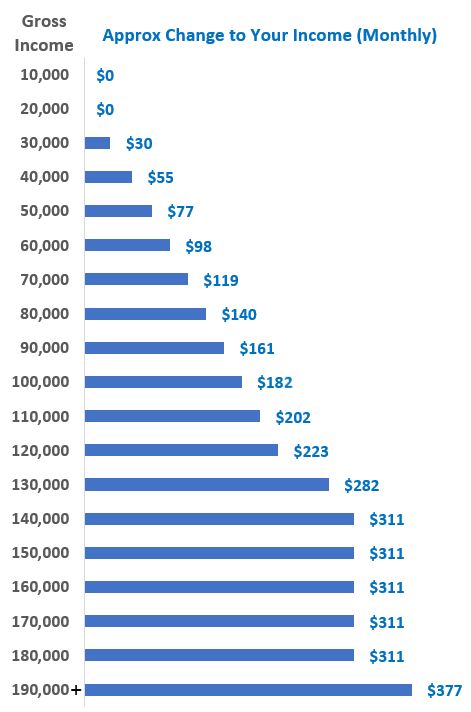

To provide further clarity on the impact stage 3 will have on your monthly income, our friends over at Etax Accountants created a graph illustrating the approximate increase in your monthly pay in the 2024-25 financial year: (Tap graph to expand)

Stage 3 tax cuts calculator

Want to get down the fine details? Find out how the stage 3 tax cuts will affect your exact income, using the Treasury’s stage 3 tax cuts calculator:

Sources and further reading:

- https://www.abc.net.au/news/2024-02-03/stage-three-tax-cuts-substance-spin/103404984

- https://treasury.gov.au/sites/default/files/2024-01/tax-cuts-government-fact-sheet.pdf

- https://treasury.gov.au/tax-cuts/calculator

Business and Individual tax services provided by Etax Local:

Need a quote or more information about our services? Our team are always happy to help.

Tax Agent

Tax Agent