The first thing you need to know about teacher tax deductions is: there are a lot of them!

Tax deductions for teachers are numerous, so if you know what you’re entitled to claim you could see a nice increase in your tax refund when you do your next tax return.

Let’s be honest though, the last thing you want to do after a day in the classroom, a school trip or getting through that mountain of marking is try to work out what teacher tax deductions you can claim on your tax return, right?

Sure, there is plenty of information to wade through on the ATO website, but that’s not easy and it’s definitely not fun!

Instead, when you’re ready to do your tax return, take a little time out from teaching others and teach yourself a few basics about teacher tax deductions, the easy way.

How?

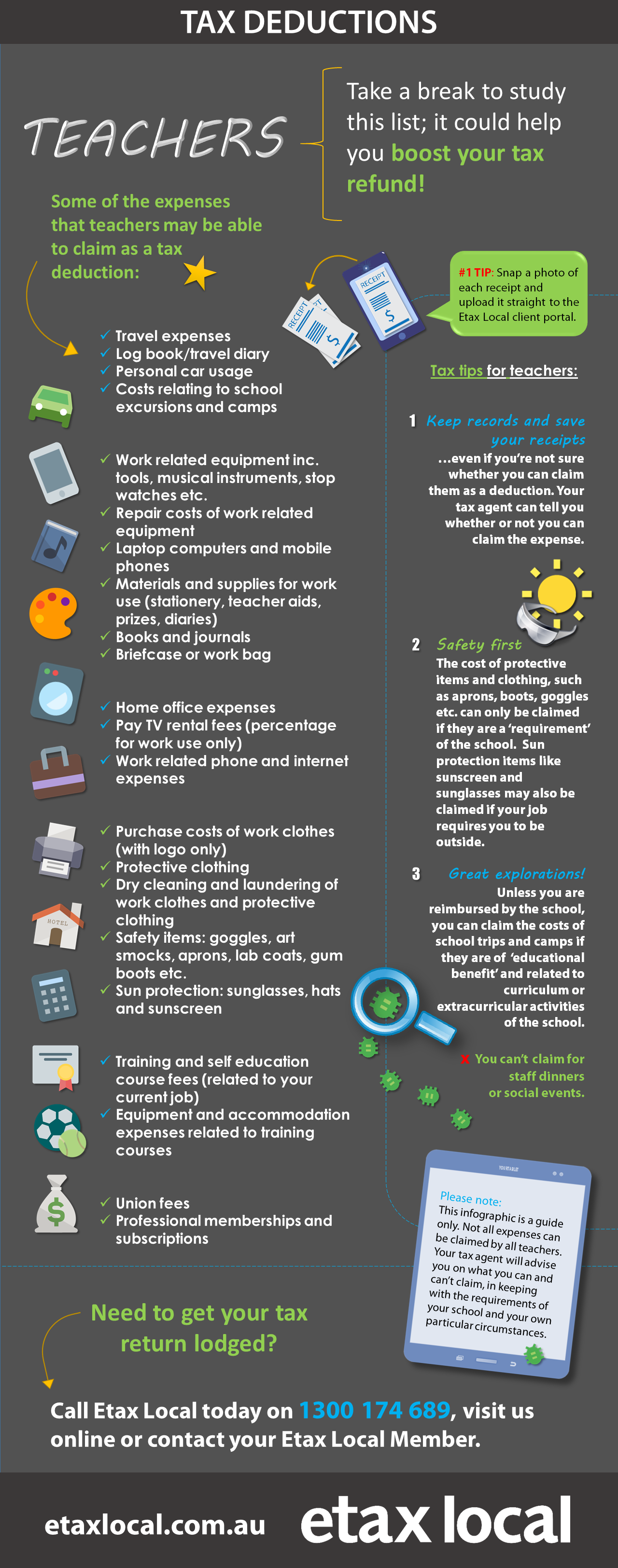

Etax Local has the basics covered this year with a simple list of tax deductions that teachers may be able to claim, together with a few handy tax tips, all wrapped up in our easy to digest infographic. Who said tax couldn’t be fun?

Please Note: As with many professions, teachers need to meet certain criteria – or in some cases, be in receipt of employer allowances – to be eligible to claim some of their work related expenses as tax deductions. Check with a registered tax agent like Etax Local if you’re not sure.

Our biggest tip regarding teacher tax deductions though? If you paid for anything that was related to your work, keep the receipt!

Our accountants will be able to tell you whether or not you can claim a tax deduction for an expense you’re not sure about – but it’s worth remembering you can’t claim anything that you don’t have a receipt for!

Tax Agent

Tax Agent